- #How to file extension for business tax return in nj for free

- #How to file extension for business tax return in nj how to

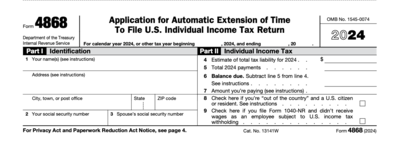

The application for extension of time to file a New Jersey Gross Income Tax return (Form NJ-630) must be filed (postmarked) no later than the original due date of the return. You have until June 15 to file this form. federal Application for Automatic Extension (if filed by paper) with the final New Jersey return when filed. Contact the IRS at 1-80 or visit their website at to obtain. Attach a copy of Federal Form 4868 or the IRS confirmation letter (if you request a Federal extension electronically) to the Georgia return when filed. If you can't file by the automatic two-month extension date, you can file a Form 4868 to request an additional extension to Oct. The due date for filing your Georgia return will be automatically extended with an approved Federal extension. When you do file your return, include a statement that explains why you qualified for the later deadline. This also applies to military members serving outside the U.S. citizen or resident alien and you live and work outside the U.S. You automatically get two extra months until June 15 to file your federal tax returns without submitting an IRS extension request for if you’re a U.S. Check your state's tax authority website for more information. State extensionĮach state has its own tax-filing extension rules. If you pay less than 90 percent of the tax you owe, you’ll be charged a penalty of 0.5 percent of the underpayment every month until you pay the balance. If you underestimate what you owe, you may end up paying interest on what you don’t pay by the deadline. You still need to pay what you owe by April 15, even if you file for an extension. If you expect a refund, you won't get it until after you file your tax returns and the IRS processes that return.

You can also print out Form 4868 and send it to the IRS address for your state by April 15. These often help you estimate your tax due so you can make a payment.

#How to file extension for business tax return in nj for free

You can e-file an extension for free using any of the Free File software offered by the major tax preparation companies. Almost every state imposes a business or. Instead, each partner reports their share of the partnerships profits or loss on their individual tax return.

Partnerships, however, file an annual information return but dont pay income taxes. More tax headaches: Another tax headache ahead: IRS is changing paycheck withholdings and it'll be a doozyĪpril deals: Your monthly guide to food specials, meal deals and more Extension needed Most businesses must file and pay federal taxes on any income earned or received during the year.

#How to file extension for business tax return in nj how to

Here's how to get the extra time you need. 16, 2021.The process is straightforward - and easier to do than completing your actual returns. 16, will be abated as long as the deposits are made by Sept. In addition, penalties on payroll and excise tax deposits due on or after Sept. Businesses with an original or extended due date also have the additional time including, among others, calendar-year partnerships and S corporations whose 2020 extensions run out on Sept. 15, 2021, and calendar-year corporations whose 2020 extensions run out on Oct. 15, 2021. It also applies to tax-exempt organizations, operating on a calendar-year basis, that had a valid extension due to run out on Nov. 15, 2021. 15, 2021, and quarterly payroll and excise tax returns normally due on Nov. 1, 2021. The new deadline also applies to quarterly estimated income tax payments due on Sept. The IRS noted, however, that because tax payments related to these 2020 returns were due on May 17, 2021, those payments are not eligible for this relief.

This means that individuals who had a valid extension to file their 2020 return by Oct. The relief applies to filing and payment deadlines that occurred starting on Sept. 3, 2022, to file various individual and business tax returns and make tax payments. In New York, this currently includes Bronx, Kings, New York, Queens, Richmond and Westchester counties, and in New Jersey, it includes Bergen, Gloucester, Hunterdon, Middlesex, Passaic and Somerset counties. These taxpayers now have until Jan. Specifically, the extensions apply to those residing in areas designated by the Federal Emergency Management Agency (FEMA) as qualifying for individual or public assistance. The IRS has extended filing deadlines for taxpayers in New York and New Jersey who were affected by Hurricane Ida.

0 kommentar(er)

0 kommentar(er)